By Oluwole Smile and Olumide Taiwo PhD

Demographic dividend describes the achievement of accelerated economic growth that is driven primarily by changes in population age structure in the course of a country’s transition from high to low fertility and mortality rates. The Demographic dividend describes the achievement of accelerated economic growth that is driven primarily by changes in population age structure in the course of a country’s transition from high to low fertility and mortality rates.

The precondition to demographic dividend is the opening of the demographic “window of opportunity.” The United Nations defines the window as the period in the demographic transition when “those under 15 years old have fallen permanently under 30 percent, but those 65 years and older are still relatively few.” The window remains open as long as fertility continues to fall or remains low and the dependency ratio continues to fall. However, the population of the elderly begins to rise gradually. The widow is considered to remain open as long as the elderly remains below 15 percent of the population. In essence, the population at this stage of the transition is dominantly at work or ready for work.

Methodology: The National Transfer Accounts (NTA)

While there are different approaches,[1] an economic lifecycle approach to examining the demographic dividend is considered the most insightful for policy purposes, and has been adopted by the United Nations Development Program (UNDP 2014). The approach considers the economic lifecycle as consisting of three phases: the childhood or preparatory phase, the adulthood or working-age phase, and the elderly or retirement phase. An individual is an economic dependent (consuming more than producing) during the childhood and elderly phases and an economic supporter (producing more than consuming and therefore saving/investing) during the adulthood phase. The first demographic dividend arises from compositional changes in population that yield rapid growth of supporters relative to dependents while the second dividend arises from the productivity and growth effects of assets created by economic supporters.

The deficits generated by children and the elderly are funded by the savings of the working-age adults through various means including investments (to fund own consumption in old age and transfer assets to children), private (intra and inter-household) transfers and public transfers funded by taxation of labor income (including wage-employment and self-employment earnings) of working adults and asset income of both working adults and the elderly. The profile of consumption and labor income, the magnitude of age-specific deficits and inter-generational transfers that fund the deficits are the subjects of the National Transfer Accounts (NTA). An aggregate lifecycle deficit (LCD) is estimated using the NTA and population data.

A fully completed NTA reflects four important attributes of the economy: 1) the demographic and epidemiological profile of the country, 2) the labor market viz. labor force participation, employment and earnings, which also reflect productivity of the underlying economy, 3) the structural pattern of consumption and savings, which also reflect the state of the financial system, and 4) public spending on social sectors, mainly education and health. Through the signed memorandum of understanding (m.o.u) between CHECOD and National Bureau of Statistics (NBS), the Harmonized National Living Standard Survey (HNLSS) 2010 dataset were collected from NBS to carry out economic lifecycle deficit analysis which is the first part of the National Transfer Accounts.

Where are we?

With estimated 177 million people in 2014, Nigeria’s population is projected to rise to 396 million by 2050, moving the country from the 7th in 2015 position to the 3rd position in world population. By that time, Nigeria will be behind only the duo of India and China in terms of population.

The implications for the labor market are dire. Using data from the UN population program, the working-age population (age 15-64) will rise to 260 million and the labor force will rise to 172 million by 2050. Beginning from late 2000s, entrants into the labor force had become more rapid than any time in the past, and the pace is projected to continue till 2070 when the country is projected to reach the peak of the youth bulge. The rate of new entrants will rise from average of 2.4 million working-age individuals per year during 2011-2015 to 7.6 million during 2066-2070, and drop to 5.1 million during 2096-2100.

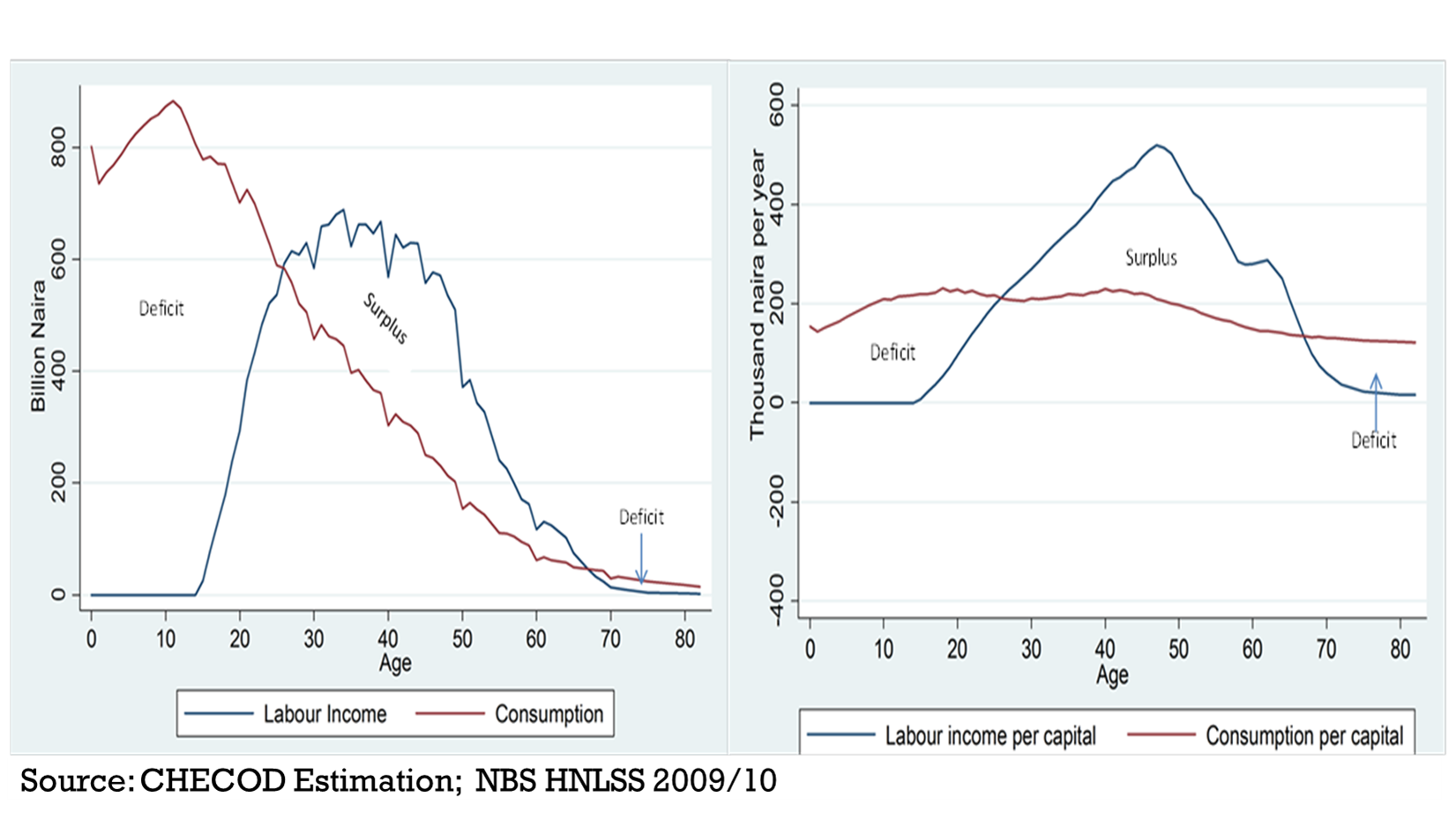

Using the economic lifecycle approach, the figure above shows the consumption and labor income profile for Nigeria taken from the NTA based on 2010 data. In aggregate terms, the estimated value of the lifecycle deficit for Nigeria economy as a whole is about 9.67 trillion naira, with aggregate consumption 30.91 trillion naira and labor income of 21.25 trillion naira. The results show that population age groups 0 to 26 years earn less than they consume, as well as population group age 67 years or older. In contrast, population age 27 to 66 year earned more in labor income than they consumed, and thus generate surpluses.

This shows the aggregate flows that made up the LCD in 2010. These age-specific estimates are aggregated into six broad age-groups. The table shows that population under age 30 generated a deficit of 16.58 trillion naira (78% of aggregate labor income) and those older than 64 generated a deficit 110.8 billion naira (0.52% of aggregate labor income).Compared to the surplus generated by working adults age 30 to 64 which is approximately 7.03 trillion naira (33.07% of aggregate labor income), net lifecycle deficit (LCD) for the aggregate economy in 2010 was 9.67 trillion naira (45.45% of total labor income).

However, this picture applies to the aggregate economy; the picture will vary across states and regions depending on many factors including the demographic structure, the structure of production and consumption, labor force participation, employment and earnings, and financial markets at the state level. As expected, these will be diverse. The lifecycle deficit is funded by borrowing against future earnings from domestic and international financial markets, public resource transfers, disposal of existing earnings-generating assets, and other mechanisms that hamper future earnings-generation capabilities. At the macroeconomic level, this leads to current account deficits which eventually hamper economic growth. As a golden rule, lifecycle deficit should be positive for sustained economic growth and return to zero when the economy reaches the steady state (Mason et al. 2006; Lee 1994b).

[1] For example see Bloom et al (2010).

For more details: Contact: info@checod.org; o.smile@checod.org